Under His Thumb: The Effect of President Donald Trump’s Twitter Messages on the US Stock Market

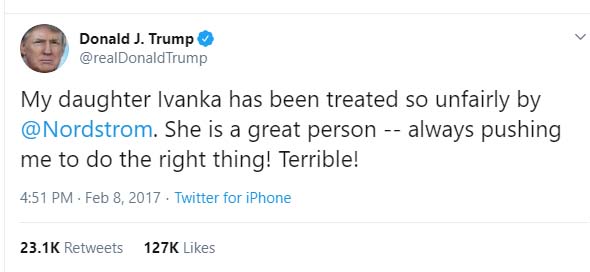

Does president Trump’s use of Twitter affect financial markets? The president frequently mentions companies in his tweets and, as such, tries to gain leverage over their behavior. In an open access study in PLOS ONE, Heleen Brans and Bert Scholtens (University of Groningen) analyze the effect of president Trump’s Twitter messages that specifically mention a company name on its stock market returns. They investigate a period of two years in which the president tweeted about one hundred times with the explicit mention of a company name.

The authors study how investors in the US stock market respond to such tweets by investigating the abnormal stock market return of the company associated with these tweets, while accounting for risk and the market trend. They also investigate whether the sentiment of the tweets matters. To this extent, they rely on SentiStrength, which extracts sentiment strength from informal text. Accounting for sentiment is a novel feature in this type of financial market analysis.

Not economically meaningful

The authors conclude that on the day of the president’s tweet about a company and on the first day thereafter, there is no statistically significant effect on the stock market value of the mentioned company. As such, it seems the president does not move the stock market with his tweets in a statistically significant way and the tweets are not economically meaningful. These results confirm those from some other studies, which used a much smaller sample. However, they contrast with a study based on a sample of fifteen tweets between the presidential elections and the swearing in of president Trump.

Reduced market value

However, when they account for sentiment of the tweet, Brans and Scholtens find that tweets from the president that reveal strong negative sentiment are followed by reduced market value of the company mentioned. The president’s supportive tweets do not render a significant effect. This finding of asymmetry aligns with other studies in finance.

These results show that president Trump’s tweets about companies can have a negative impact on their market value when the tweets reveal strong negative sentiment. The firms themselves usually are not in a position to respond.

The methodology used does not allow the authors to conclude about the exact mechanism behind the findings and can only be used to investigate short-term effects.

More information

- Contact: Bert Scholtens

- Full publication: Brans H., Scholtens B. (2020), Under his thumb. The effect of president Donald Trump’s Twitter messages on the US stock market. PLoS ONE 15(3): e0229931

More news

-

09 December 2025

Are robots the solution?

-

10 November 2025

Decentralization of youth care