Beleggers in Shell en ExxonMobil ongevoelig voor aardbevingen Slochterenveld

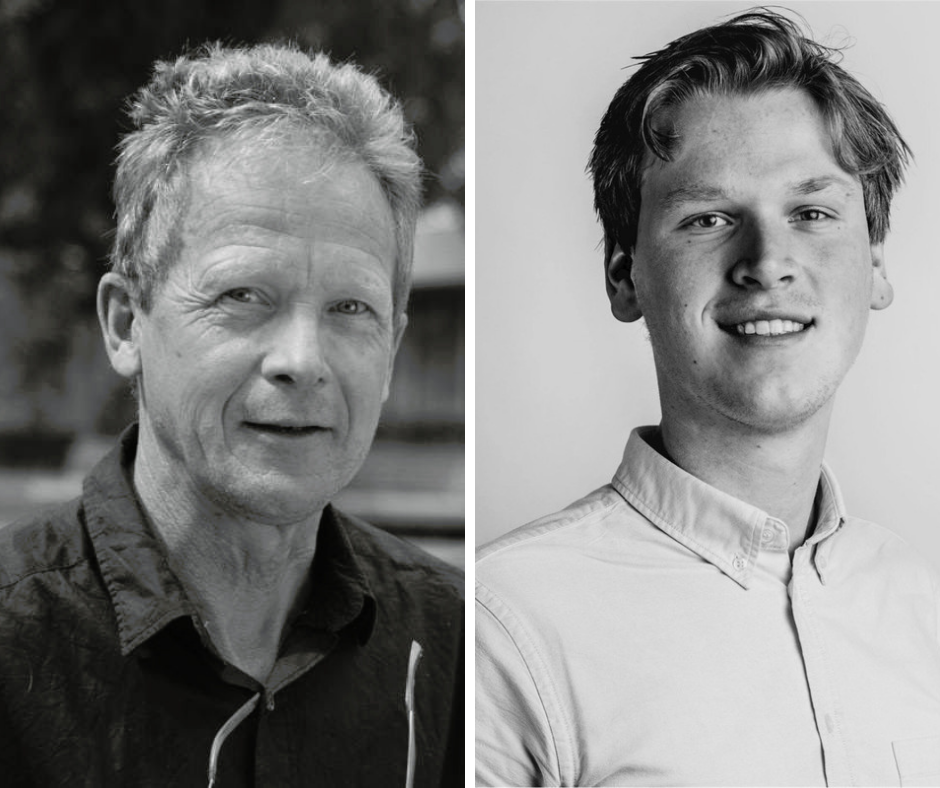

Beleggers in Shell en ExxonMobil reageren nauwelijks als er aardbevingen zijn die samenhangen met de winning van fossiele brandstoffen. Dit blijkt uit onderzoek van Matthijs Jan Kallen en Bert Scholtens van de Rijksuniversiteit Groningen. Zij onderzochten honderden zogenaamd geïnduceerde aardbevingen in Groningen (Slochteren) en Oklahoma (Anadarko) in de Verenigde Staten. Die aardbevingen worden toegeschreven aan de winning van fossiele energie.

Kallen en Scholtens vergeleken hoe beleggers in de twee energiereuzen reageren op dergelijke schokken, namelijk of er sprake is van buitengewone aandelenrentabiliteiten als zich zo’n aardbeving voordoet. Zo’n beving kan interessant zijn voor beleggers omdat het wellicht duidt op intensivering van de winningsactiviteit, maar ook omdat het mogelijk schade tot gevolg kan hebben. De schokken kunnen door beleggers als goed nieuws én als slecht nieuws ervaren worden.

Kallen en Scholtens onderzochten honderden geïnduceerde aardbevingen in de periode 2000-2020. Ze stelden als selectiecriterium dat het waarneembare schokken moesten zijn die niet in verband gebracht konden worden met de gebruikelijke geofysische oorsprong van aardbevingen. Daartoe kozen ze aardbevingen met een kracht tussen 1 en 4 op de schaal van Richter. Uit ander onderzoek kwam namelijk naar voren dat de geïnduceerde bevingen meestal binnen deze bandbreedte vallen. Daarnaast moest er voldoende tijd zitten tussen de bevingen zodat er geen wisselwerking mogelijk was in zowel schokken als reactie van de beleggers. Op grond hiervan bleven er 423 schokken over in het Slochterenveld en 552 in het Anadarko Basin. Kallen en Scholtens onderzochten Shell en ExxonMobil omdat deze bedrijven direct of indirect betrokken zijn bij de energiewinning in beide gebieden en omdat er volop in gehandeld wordt.

Uit de analyse komt naar voren dat beleggers in Shell niet lijken te reageren op de geïnduceerde bevingen. Daarentegen gaan deze bevingen samen met significant positieve aandelenrentabiliteiten voor beleggers in ExxonMobil. In financieel-economische zin zijn die effecten echter uiterst beperkt voor deze beleggers. Het verschil tussen de reactie van beleggers in beide bedrijven op dezelfde aardbevingen is niet significant voor het Slochterenveld, maar wel voor bevingen in Oklahoma. Dit betekent dat beleggers in ieder geval niet negatief lijken te reageren op aardbevingen. Volgens Kallen en Scholtens achten beleggers de bevingen niet relevant voor de waarde van de ondernemingen, ook niet als dit maatschappelijke schade teweegbrengt. Beleggers zullen de effecten al in hun waardering verrekend hebben.

Meer informatie

Zie de volledige publicatie: Kallen, M.J. & Scholtens, B. Movers and Shakers: Stock Market Response to Induced Seismicity in Oil and Gas Business. Energies 2021,14, 8051 of (researchgate).

Meer nieuws

-

10 februari 2026

‘Regeneratie begint waar moed en verbeeldingskracht samenkomen’

-

09 december 2025

Zijn robots de oplossing?