Tweets van Trump alleen van invloed op financiële markten als ze negatief van toon zijn

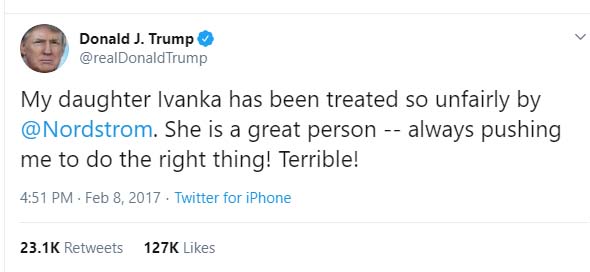

Hebben tweets van Donald Trump invloed op financiële markten? De Amerikaanse president noemt veelvuldig bedrijven in zijn tweets in een poging hen te beïnvloeden. Heleen Brans en Bert Scholtens van de Rijksuniversiteit Groningen onderzochten dergelijke tweets in de eerste helft van Trumps presidentschap. Voor die periode analyseerden ze ongeveer honderd tweets waarin de president expliciet melding maakt van een bedrijf. Ze publiceren hun bevindingen in het ‘open access’ (vrij toegankelijke) tijdschrift PLOS ONE.

Brans en Scholtens bestudeerden hoe beleggers in de VS reageren op dergelijke berichten. Daartoe berekenden ze de buitengewone aandelenrentabiliteiten van de genoemde bedrijven, daarbij rekening houdend met het specifieke risico van het bedrijf en de markt. Ook onderzochten ze of de toon van de tweet relevant is voor de koersreactie van de aandelen.

Geen effect op korte termijn

Brans en Scholtens concluderen dat de waarde van bedrijven in ieder geval op de korte termijn niet beïnvloed wordt door de tweets van president Trump. Dit duidt erop dat dergelijke tweets geen economische betekenis hebben. Ofwel, Trump heeft de economie niet onder de duim. Maar als de auteurs rekening houden met de toon van de tweets vinden ze wél een duidelijk effect. Namelijk dat sterk negatief getoonzette tweets samenhangen met een daling van de marktwaarde van genoemde bedrijven. Positieve tweets blijken géén effect te hebben.

In lijn met wetenschappelijke literatuur

De resultaten van Brans en Scholtens bevestigen meer algemene bevindingen over dit onderwerp in de wetenschappelijke literatuur. Brans en Scholtens tonen aan dat de tweets van president Trump een negatief effect kunnen hebben op de waarde van het bedrijf dat in negatieve zin wordt genoemd. De door hen gebruikte methode maakt het niet mogelijk om na te gaan waardoor het effect specifiek optreedt en is alleen geschikt om effecten op de korte termijn te meten.

Meer informatie

- Contact: hoogleraar Bert Scholtens

- De volledige publicatie: Brans H, Scholtens B (2020) Under his thumb. The effect of president Donald Trump’s Twitter messages on the US stock market. PLoS ONE 15(3): e0229931.

Meer nieuws

-

09 december 2025

Zijn robots de oplossing?

-

10 november 2025

Decentralisatie van de jeugdzorg