Highest increase in municipal residential taxes since 2007

This year, the increase in municipal residential taxes will be significantly higher than the inflation rate. Tenants will pay 5.1 percent more; owner-occupiers 4.3 percent. The waste collection levy will increase significantly – by 5.9 percent – as many municipalities are only now adjusting their levies on the basis of an increase in a state tax in 2019. Property tax will increase relatively significantly – by 4 percent – partly due to shortfalls in government funding for the social domain. This is the conclusion of the report ‘Kerngegevens Belastingen Grote Gemeente 2020’ (Key Data on Taxes for Large Municipalities in 2020), which has been drawn up by the Centre for Research on Local Government Economics (COELO) of the University of Groningen.

For this annual overview, COELO researched the residential tax rates of 40 large municipalities, in which 41 percent of the Dutch population lives. The full report, including separate figures from all of the large municipalities, can be found at www.coelo.nl.

Residential taxes for owner-occupiers

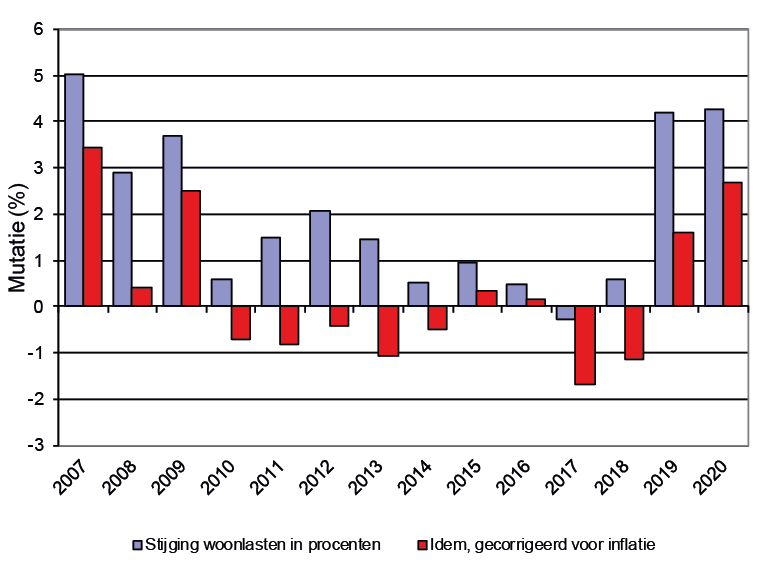

Municipal residential taxes (property tax, sewerage charges and the waste collection levy) for multi-person households that own their home will increase by € 30 (4.3 percent) on average, to € 734 per year. In comparison, the inflation rate is expected to be 1.6 percent in 2020. This will be the second consecutive year in which the increase in residential taxes is relatively significant (see Figure).

This development in residential taxes is caused, in the first place, by the significant increase in the waste collection levy (by 5.9 percent, or € 17). The average property tax rate will increase by 4 percent (€ 9.78). Owner-occupiers will pay 1.9 percent more on average for sewerage charges (€ 3.14). The average residential taxes will be the highest in Leiden (€ 878) and lowest in The Hague (€ 597).

Residential taxes for tenants

Households in rented accommodation will pay a waste collection levy and, in some municipalities, will also pay sewerage charges. In 2019, households paid € 18 more (5.1 percent) on average than they did in the previous year. This is mainly due to the significant increase (by € 17 on average) in the waste collection levy in many municipalities. Sewerage charges for tenants will increase by an average of € 0.49 (0.9 percent).

Waste collection levy to rise by 5.9 percent

Waste collection and processing is financed by the waste collection levy. Multi-person households will pay € 306 on average for the waste collection levy; 5.9 percent more than last year. This relatively significant increase is due to the fact that the government significantly increased the waste collection levy in 2019 (by 139 percent). In 2019, some of the municipalities financed this cost increase from their reserves and will only now begin to charge the increase in costs to households by means of the waste collection levy. In addition, municipalities will encounter a reduction in revenue due, among other things, to the reduction in proceeds from collected paper and plastics.

In Arnhem, the waste collection levy is estimated to be reduced by 4.1 percent because, as from 1 July 2020, the Municipality will transition to another residential tax rate system (payment will be made each time that waste is thrown into a communal waste container). In Apeldoorn, the waste collection levy will increase by 38 percent. Households in Nijmegen will pay the least, as they did in 2019 (€ 40 on average), because a large part of the costs of waste collection and processing is paid from property tax revenues. Households in Haarlem will pay the most (€ 392 on average).

Property tax to increase by 4 percent

Tenants do not pay municipal property tax but homeowners do: on average, they will pay € 256 in 2020. That is 4 percent more than last year. This will vary, from a decrease of 1 percent in Arnhem to an increase of 15.2 percent in Groningen. Households in Amsterdam will pay the least in the country (€ 150 on average); those in Nijmegen the most (€ 569).

Increase in sewerage charges for tenants is lower than inflation

Municipalities can choose whether to charge sewerage charges to homeowners, to tenants or to both. Tenants will pay € 57 on average for sewerage charges; 0.9 percent more than in 2019. The increase is therefore lower for tenants than the expected inflation rate of 1.6 percent. In 14 large municipalities (in which 35 percent of the population live), tenants do not pay sewerage charges. In the municipalities within which tenants do pay sewerage charges, the rate will vary for single-person households and multi-person households, from € 28 in Oss to € 284 in Zaanstad.

Owner-occupiers in Tilburg will pay the least for sewerage charges (€ 96); those in Zaanstad the most (€ 284). On average, owner-occupiers will pay € 172 for sewerage charges; 1.9 percent more than last year.

More information

- For further information, please contact Dr Corine Hoeben, researcher at COELO

- The full publication can be found at www.coelo.nl

- Kerngegevens belastingen grote gemeenten 2020, COELO, Groningen

More news

-

09 December 2025

Are robots the solution?

-

10 November 2025

Decentralization of youth care