Beperkte stijging belastingen grote gemeenten

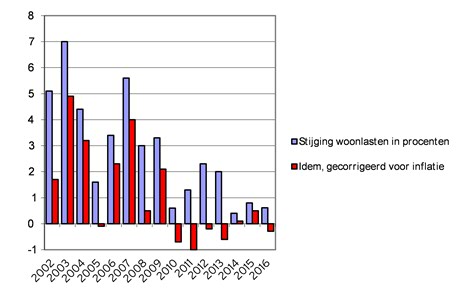

De grote gemeenten verhogen hun woonlasten dit jaar met gemiddeld 0,6 procent. Dat is een kleinere stijging dan vorig jaar. Gecorrigeerd voor inflatie (0,9 procent) is sprake van een lichte daling. Dat blijkt uit het rapport Kerngegevens belastingen grote gemeenten 2016, dat is opgesteld door het Centrum voor Onderzoek van de Economie van de Lagere Overheden (COELO) van de Rijksuniversiteit Groningen.

COELO onderzocht voor dit jaarlijkse overzicht de tarieven van 36 grote gemeenten, waarin 38 procent van de Nederlandse bevolking woont. Het volledige rapport, met cijfers over alle afzonderlijke grote gemeenten, is te vinden op www.coelo.nl.

Decentralisaties drijven lasten niet op

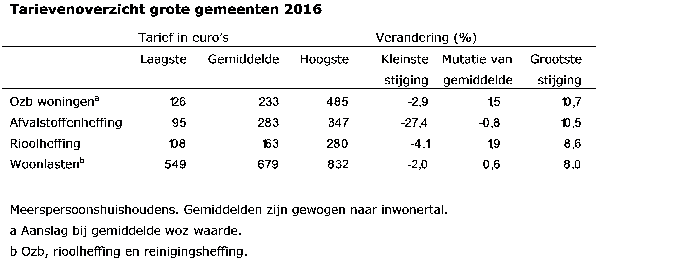

De gemeentelijke woonlasten (ozb, rioolheffing en afvalstoffenheffing) stijgen gemiddeld met 4 euro (0,6 procent) tot 679 euro per meerpersoonshuishouden per jaar. Als we rekening houden met inflatie (0,9 procent) is sprake van een lichte daling. Het is niet vanzelfsprekend dat de stijging van de lokale lasten zo beperkt is. Gemeenten kregen er immers grote taken bij op het gebied van zorg, jeugd en werk (de drie decentralisaties). Gemeenten ontvangen hiervoor aanzienlijk minder geld dan het rijk en de provincies er vroeger voor nodig hadden. Maar dit leidt dus in 2016 opnieuw niet tot een grote lastenstijging bij de grote gemeenten.

Lasten Venlo meest omlaag

‘s-Gravenhage heeft de laagste woonlasten (547 euro), buurgemeente Delft de hoogste (820 euro). Maar liefst dertien gemeenten verlagen hun woonlasten, Venlo het meest (met 2,0 procent). In Amersfoort stijgen de woonlasten voor meerpersoonshuishoudens het sterkst (9,8 procent).

Rioolheffing stijgt procentueel het meest

De gemiddelde rioolheffing stijgt met 1,9 procent (3 euro) het sterkst. Deze stijging is echter in het verleden vaak hoger geweest. Amersfoort verhoogt de rioolheffing in procenten het meest (8,6 procent). Apeldoorn verlaagt de rioolheffing het sterkst (met 9,3 procent). Eénpersoonshuishoudens betalen het minst in Leiden (66 euro, de rioolheffing dekt in deze gemeente niet alle rioleringskosten) en meerpersoonshuishoudens betalen het minst in Zwolle. Zaanstad heeft voor zowel één- als meerpersoonshuishoudens het hoogste riooltarief (280 euro).

Stijging ozb 1,5 procent

Huiseigenaren betalen in 2016 gemiddeld 233 euro aan ozb. Dat is 1,5 procent meer dan vorig jaar. De stijging loopt uiteen van een daling met 2,9 procent in Alkmaar tot een stijging met 10,8 procent in Amersfoort. Het ozb-tarief is een percentage van de WOZ-waarde. Om gemeenten te vergelijken gaan we uit van de gemiddelde WOZ-waarde in iedere gemeente. In ’s-Gravenhage betalen huishoudens het minst (126 euro), in Nijmegen het meest (485 euro).

Afvalstoffenheffing daalt gemiddeld

De gemiddelde afvalstoffenheffing is met 283 euro 0,8 procent lager dan vorig jaar. Met deze heffing wordt afvalinzameling en –verwerking bekostigd. Nijmegen dekt minder dan 40 procent van de kosten uit de afvalstoffenheffing en is daardoor het goedkoopst (95 euro), Rotterdam (bij een kostendekking van 100 procent) het duurst (347 euro).

Meer informatie

Contact: dr. C. Hoeben

De volledige publicatie Kerngegevens belastingen grote gemeenten 2016 is te vinden op www.coelo.nl.

Meer nieuws

-

10 februari 2026

‘Regeneratie begint waar moed en verbeeldingskracht samenkomen’

-

09 december 2025

Zijn robots de oplossing?