Study shows collapse in confidence in investing in Britain

Managers' confidence in investing in Britain collapsed between 2013 and 2017, new research has shown.

The study of 2,618 managerial decisions by researchers at the University of Geneva, New Design University, University of Groningen, and ESCE International Business School (Tina C. Ambos, Beate Cesinger, Felix Eggers, and Sascha Kraus) found that global events such as Brexit, the policies of the Trump administration, and the political situation in Russia are affecting managers' willingness to invest in those markets.

The research gathered the views of managers in Germany, Switzerland and Austria on their decisions to internationalise in 2013 and 2017.

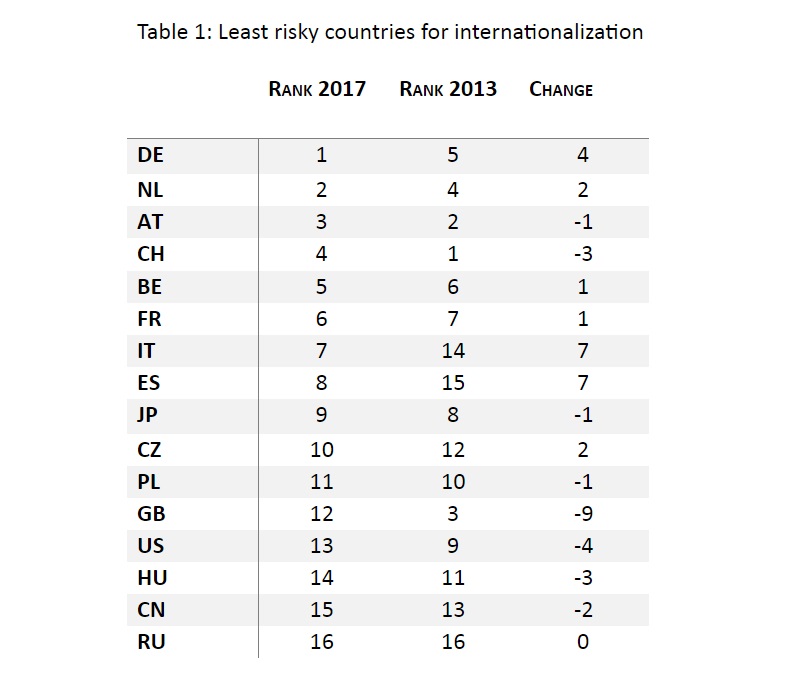

Britain was considered the third-safest place to invest by surveyed managers in 2013. In 2017 it slipped nine places, the most of any country in the study, to be seen as the 12th most-risky of 16 countries.

The United States also slipped significantly, from 8th to 13th place, while China and Hungary also fell.

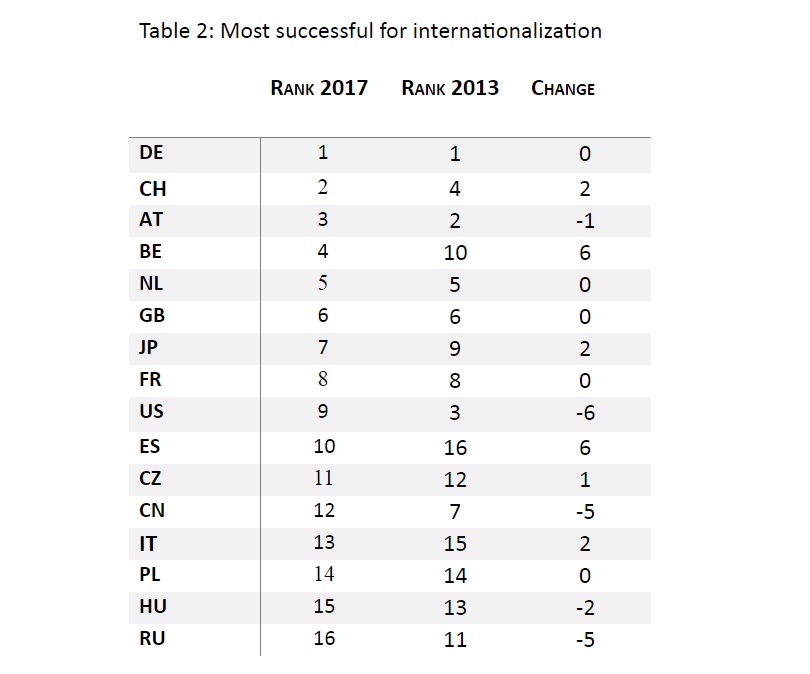

The researchers also tested managers' perceptions of which countries represent the most successful prospects for internationalisation. The United States, China and Russia declined the most in managers' eyes between 2013 and 2017.

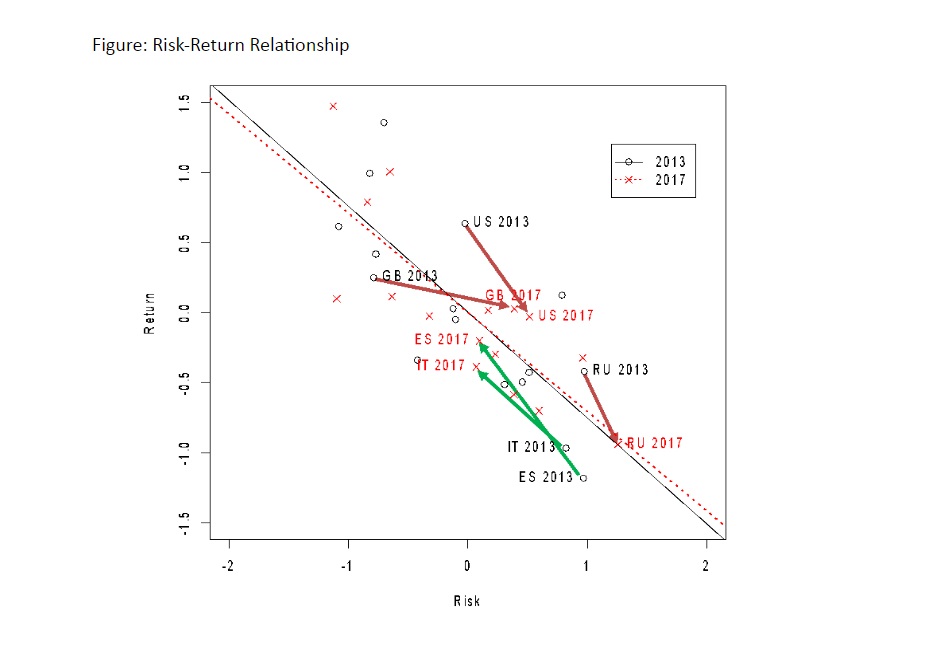

Overall, the results show that managers use a heuristic that links the perceived risk of internationalization to the expected return. Despite the changes in terms of how risky the countries are perceived this risk-return relationship remains remarkably stable. Spain, being in a financial crisis in 2013, and Italy increased the most in managers' overall assessments of risk versus return over time.

The study found overall that between 2013 and 2017 there has been a shift towards "de-globalisation". In 2013, notinvesting abroad was seen as a risky option due to the risk of missing out on opportunities. By 2017, this decision had shifted to be seen as more favourable.

In the experiment, the participants had to indicate the most risky, and separately, the most successful internationalisation strategies from choice sets that systematically varied 15 target countries and 5 market entry forms, along with the option not to internationalise.

This behavioural study shows the role of heuristics that managers use for their internationalisation decisions. It also indicates that distance is a good indicator for managerial decisions and that managers’ international experience, risk-taking propensity and shareholder status affects their decision-making heuristics.

The full paper will be published by the Global Strategy Journal and is available here.