Limited tax rise for big cities

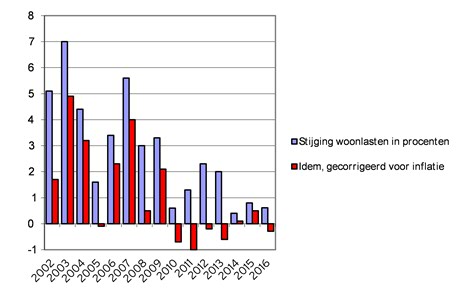

Local taxes in the big cities are increasing this year by an average of 0.6 percent, a smaller rise than last year. When corrected for inflation (0.9 percent), this represents a slight drop. These figures are contained in the report ‘Key tax figures for large municipalities 2016’, compiled by COELO, the University of Groningen’s centre for research on local government economics.

For its annual survey COELO looked at the rates levied by 36 major local authority areas, home to 38 percent of the Dutch population. The full report, with figures on each individual major municipality, can be found at www.coelo.nl.

Decentralization has not led to tax hikes

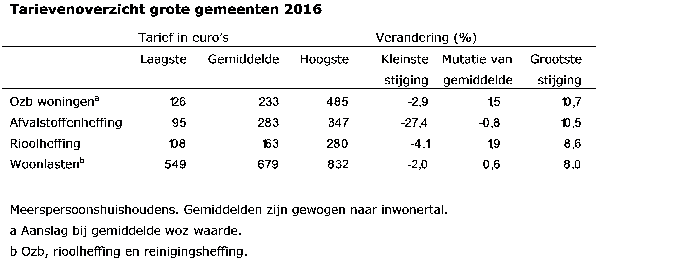

Local taxes (property tax, sewerage and refuse collection levies) has risen by an average of EUR 4 (0.6 percent) to EUR 679 per multi-person household per annum. If we take account of inflation (0.9 percent), this represents a slight drop. This limited rise in local taxes is by no means self-evident in the wake of major additional responsibilities imposed on municipalities in the areas of long-term care, youth care and employment (the ‘three decentralizations’). To meet these responsibilities they received considerably less money than required in the past by the State and provinces. But once again this has not led to a big increase in expenses for the large municipalities in 2016.

Biggest drop in Venlo

The Hague has the lowest level of local taxes (EUR 547), while its neighbour Delft has the highest (EUR 820). No fewer than 13 local authorities have reduced their taxes, most of all in Venlo (by 2.0 percent). Local taxes for multi-person households has risen most sharply in Amersfoort (9.8 percent).

Sewerage levies go up the most in percentage terms

The biggest rise – 1.9 percent (EUR 3) – is in average sewerage charges. This increase was often higher in the past, however. The sewerage levy in Amersfoort increased the most in percentage terms (8.6 percent), while Apeldoorn had the biggest drop in sewerage charges (9.3 percent).

Single-person households pay the least in Leiden (EUR 66; the sewerage levy does not cover all sewerage charges in this city) and multi-person households pay the least in Zwolle. Zaanstad has the highest sewerage levy (EUR 280) for both single and multi-person households.

1.5 percent rise in property tax

House owners will pay an average of EUR 233 in property tax in 2016. This is 1.5 percent more than last year. Changes vary from a 2.9 percent drop in Alkmaar to a 10.8 percent rise in Amersfoort. The property tax rate is a percentage of the value of the property. To compare municipalities, we used the average property valuations in each municipality. Households pay the lowest property tax in The Hague (EUR 126), and the highest in Nijmegen (EUR 485).

Average fall in waste collection levies

At EUR 283, the average waste collection levy is 0.8 percent lower than last year. This levy is used to pay for the cost of refuse collection and processing. Nijmegen covers less than 40 percent of these costs through its levy, making it the cheapest (EUR 95). Rotterdam (with a cost recovery of 100 percent) is the most expensive (EUR 347).

| Last modified: | 21 June 2022 08.24 a.m. |

More news

-

25 April 2024

Lineke Sneller appointed as Professor of Practice of Digitalization & AI in Accounting and Auditing

The Faculty of Economics and Business (FEB) is pleased to announce that as of 1 May, professor Lineke Sneller will be appointed as Professor Practice of Digitalization & AI in Accounting and Auditing. The chair is situated within the department of...

-

25 April 2024

Jenny van Doorn and co-authors receive 2024 Weitz-Winer-O’Dell Award

Jenny van Doorn and co-authors Martin Mende, Maura L. Scott (both Florida State University), Dhruv Grewal (Babson College) and Ilana Shanks (Stony Brook University) have won the 2024 Weitz-Winer-O’Dell Award. They received the award for their paper...

-

19 April 2024

New thesis prize for master's students of Economics and Business

How can we encourage economics and business students to deal with important societal challenges in their master's thesis? The 14 Dutch faculties of economics and business, united in the Council of Deans in Economics and Business (DEB), have set up...